(For the seller/landlord of Property/payee of resident contractor & professional)

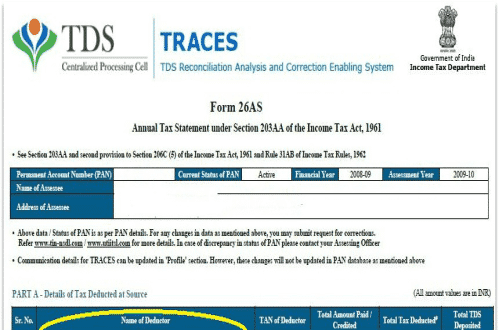

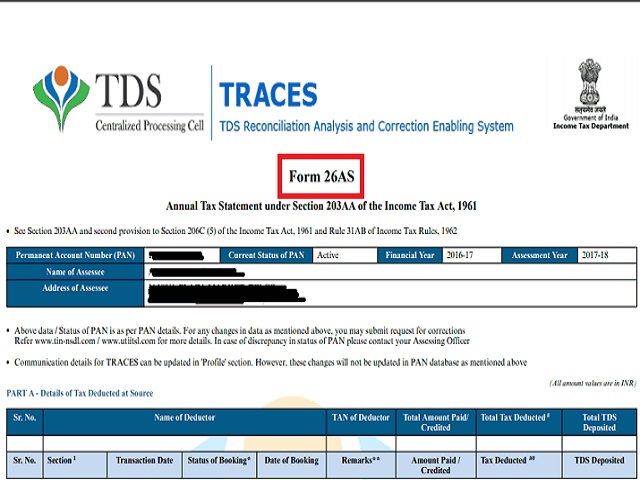

Information related to foreign remittances Information relating to completed proceedingsĪny other information in relation to sub-rule (2) of rule 114-I Information relating to pending proceedings Information relating to demand and refund Information relating to the payment of taxes (advance tax & self-assessment tax) Information relating to specified financial transactions (Property & Share Transaction Details) This helps taxpayers file their ITR with all the basic details available in Form 26AS.įurthermore, the ITD has introduced the AIS (Annual Information Statement) will now incorporate all the information related to the following: Sl. Form 26AS contains basic personal information of the taxpayer such as PAN, name, address, etc of the taxpayer. The notification states that Form 26AS will be divided into two parts Part A and Part B. The Ministry of Finance has released a new avatar of Form 26AS applicable from 1st June 2020. Form 26AS password is the D.o.B (Date of Birth) of the deductee.ĬBDT Announcement Regarding New Form 26AS & AIS The file that the user downloads are password protected. You can download Form 26AS from the Income-tax e-filing website. However, you would not want to miss out on tax credits while filing ITR. It is a very important document to have while filing ITR. Details of Tax Collected at Source (TCS) from taxpayer’s payments.Details of Tax Deducted at Source (TDS) from the taxpayer’s income.With this document, it is ensured that accurate tax has been deducted/collected from the taxpayer’s income and has been deposited with the government. What does it include?įrom AY 2023-24 onwards, Form 26AS will include every transaction where tax has been deducted (TDS) from a person’s income, be it by their employer or a bank, or any other person, and tax that has been collected (TCS) from a person. Form 26AS can be accessed by a taxpayer from the Income Tax Portal using the PAN. Steps to Convert Tax Credit Statement Text File to Excel Formatįorm 26AS is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer.Actual TDS and TDS Credit in Form 26AS do not match.

0 kommentar(er)

0 kommentar(er)